Inflation Reduction Act

Provisions to address energy production, carbon emissions reduction

August 2022

The Inflation Reduction Act, if passed and signed into law, is meant to help address inflation by reducing the national debt, healthcare costs, and energy costs over the next ten years. Key energy provisions are intended to incent, through tax credits, grants, research, and loans programs at the federal, state, and local levels, a shift by companies and individuals toward investments in products and technologies that utilize clean energy and reduce emissions.

This Act is set to be the largest congressional action on climate change, to date, with provisions that touch on a mix of energies - including wind, solar, nuclear, hydrogen, oil and gas, and biofuel - and climate-change prevention measures (such as carbon capture, battery storage, clean vehicles). These actions are likely to spur additional funding streams, inclusive of public and private efforts. Additionally, a core objective of the Act is to target its benefits to low-income/vulnerable individuals and communities, consistent with the “day one” priorities of the Administration. In the near term, enactment of the bill may lessen short-term pressures for the Administration to exercise executive authorities to effect emissions-reduction policies, including declaration of a climate emergency.

Companies should consider how the tax credits, grants and other funding incentives may factor into both short- and long-term corporate strategy, financing options, tax policy, and investment strategy, as well as how such activity in these areas may assist in their overall ESG program, measurement, and metrics across stakeholders (including regulators, investors, employees, and customers).

The U.S. Senate proposed the Inflation Reduction Act of 2022 as a substitute for H.R. 5376 (Build Back Better Act) and as part of the budget reconciliation process. It covers numerous topics, including provisions to address deficit reduction, Medicare prescription drug pricing, and healthcare premiums as well as energy security and climate change programs. Keep in mind, however, that legislative text could be modified during the legislative process.

Energy security and climate change provisions

The Senate bill (as issued in draft on July 27, 2022) would allocate an estimated $369 billion toward establishing, extending, increasing, or modifying various energy and climate change programs that collectively seek to lower consumer energy costs, increase energy security, decarbonize the economy, invest in disadvantaged communities, and support rural climate resiliency. Highlights of key provisions in each of these areas are outlined below. Notably, that amount includes an allocation of approximately $60 billion toward clean energy manufacturing in the U.S. and an additional $60 billion in environmental justice priorities to drive investment into disadvantaged communities.

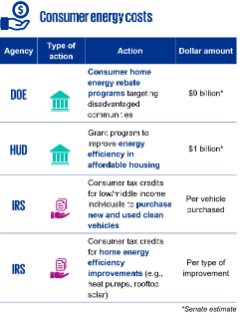

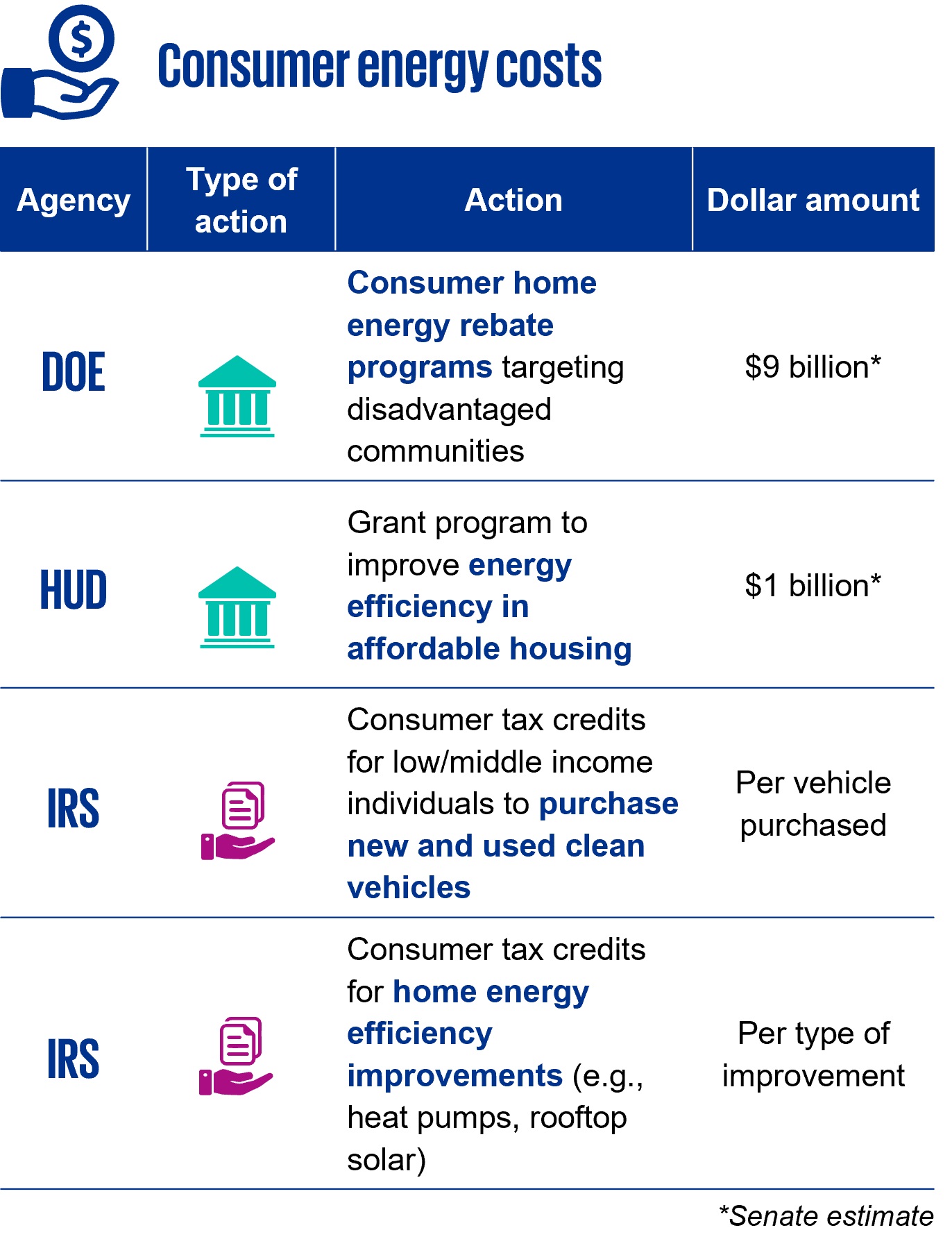

Consumer energy costs

These provisions cover a range of direct incentives to consumers to purchase energy efficient and electric appliances, clean vehicles, and roof-top solar. The bill would also provide grant money to improve energy efficiency in affordable housing.

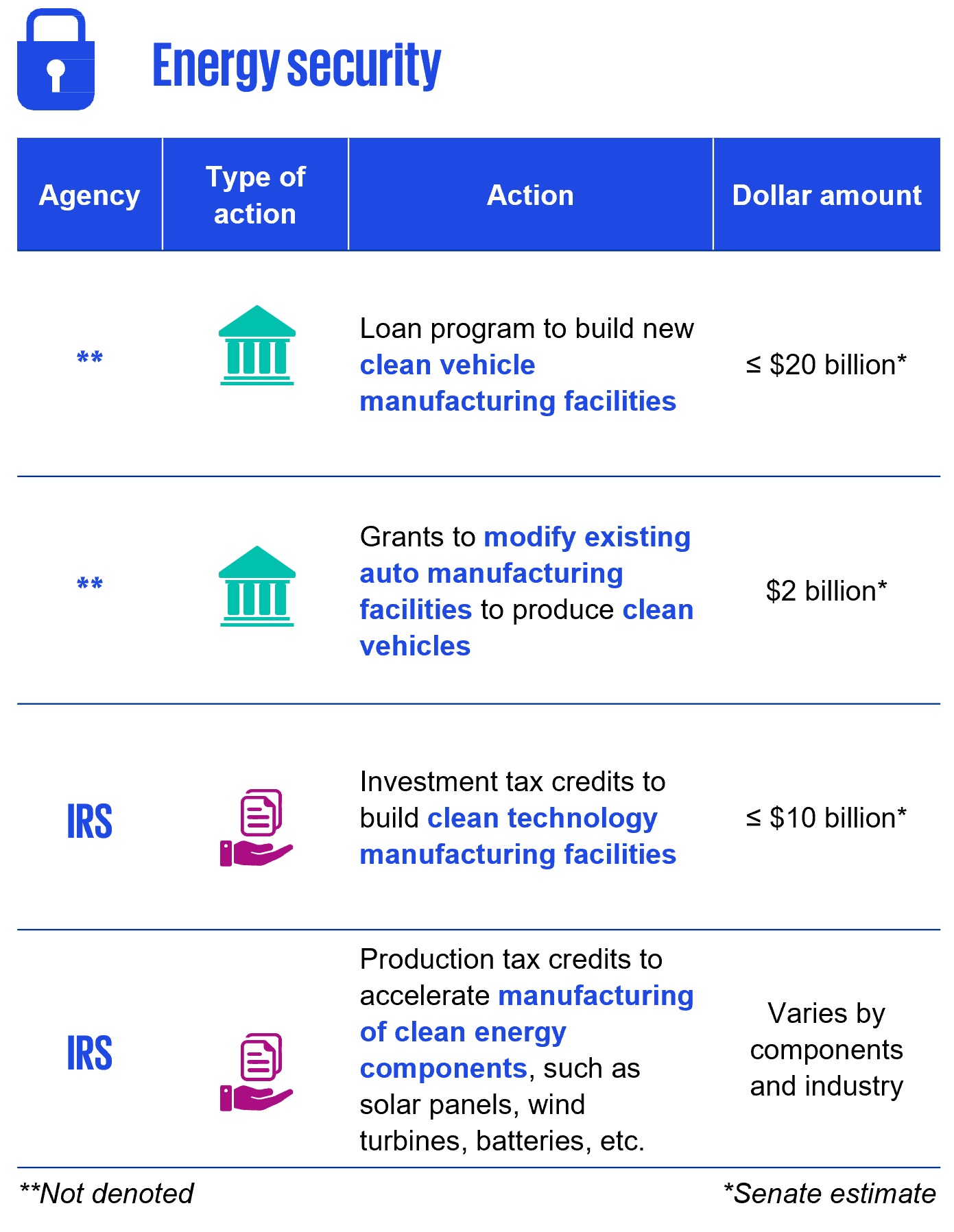

Energy security

These provisions would aim to support energy reliability and clean energy production, and invest in clean energy manufacturing These incentives aim to reduce the risk of future price shocks by lowering the cost of clean energy and clean vehicles and relieving supply chain bottlenecks by accelerating U.S. production.

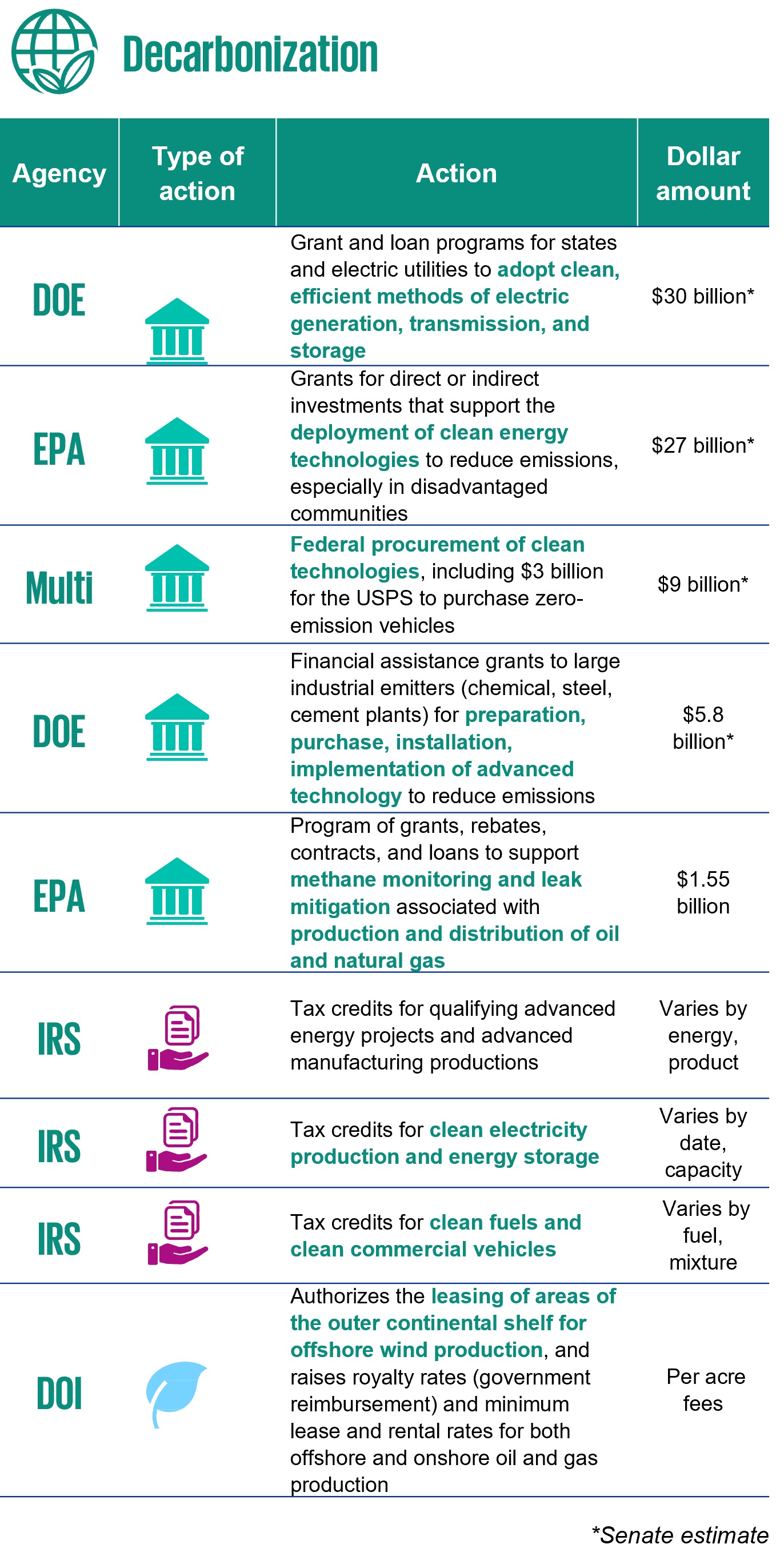

Decarbonization

These provisions aim to reduce emissions in all sectors of the economy and substantially reduce emissions from electricity production, transportation, industrial manufacturing, buildings, and agriculture through numerous grants and tax incentives, as well as opening more areas for offshore wind leases.

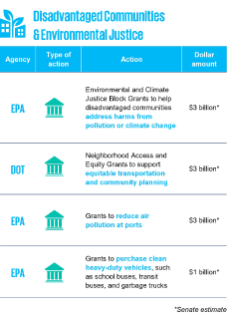

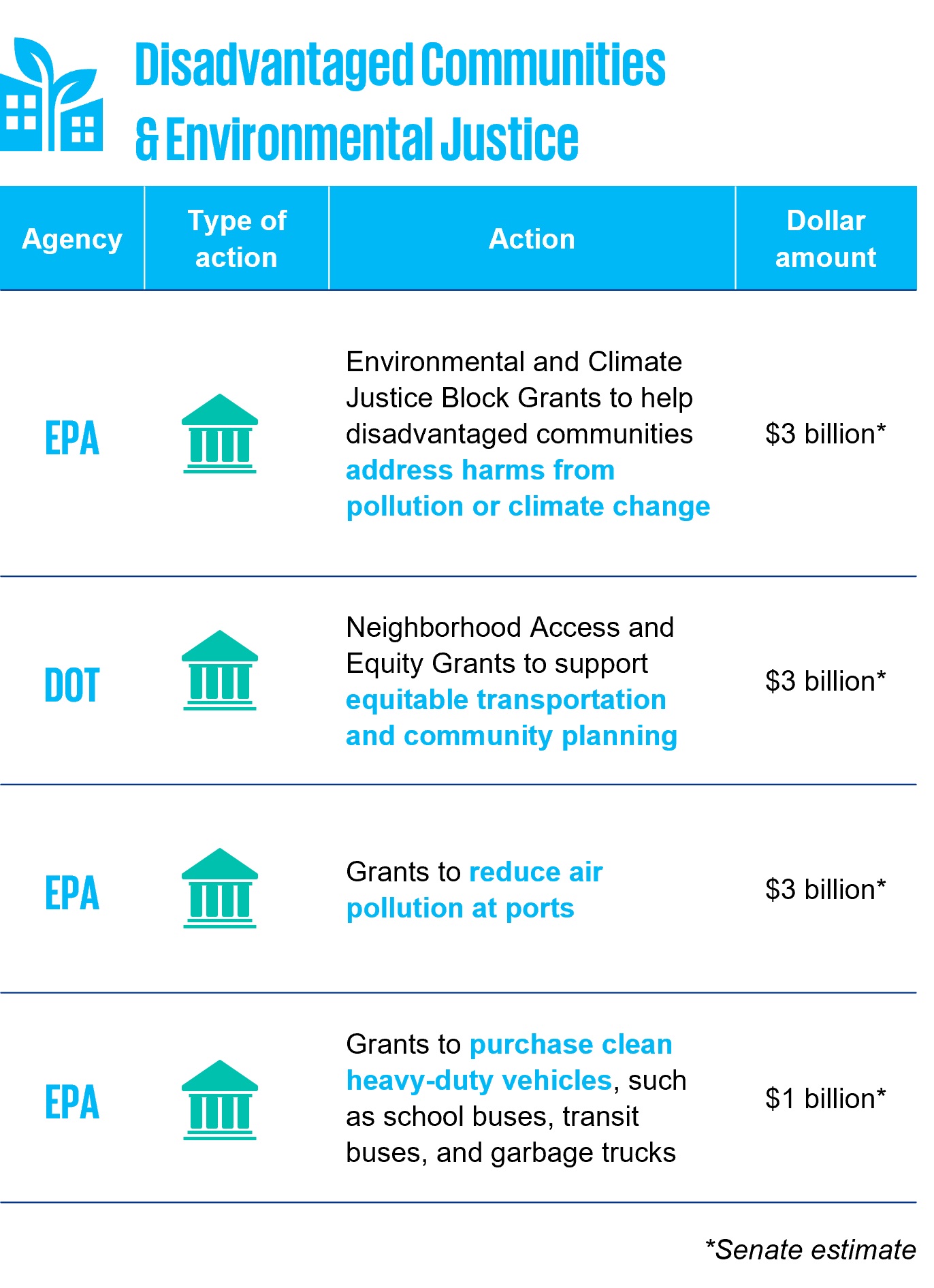

Disadvantaged Communities & Environmental Justice

These provisions aim to support environmental and climate justice priorities, improve neighborhood access and equitability, and address air pollution. The bill allocates over $60 billion to these initiatives, including specific provisions and also targeting many of the grants and tax incentives in other sections towards disadvantaged communities.

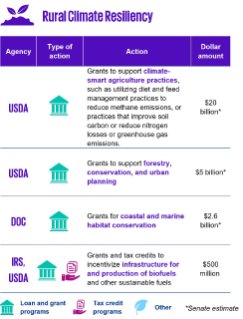

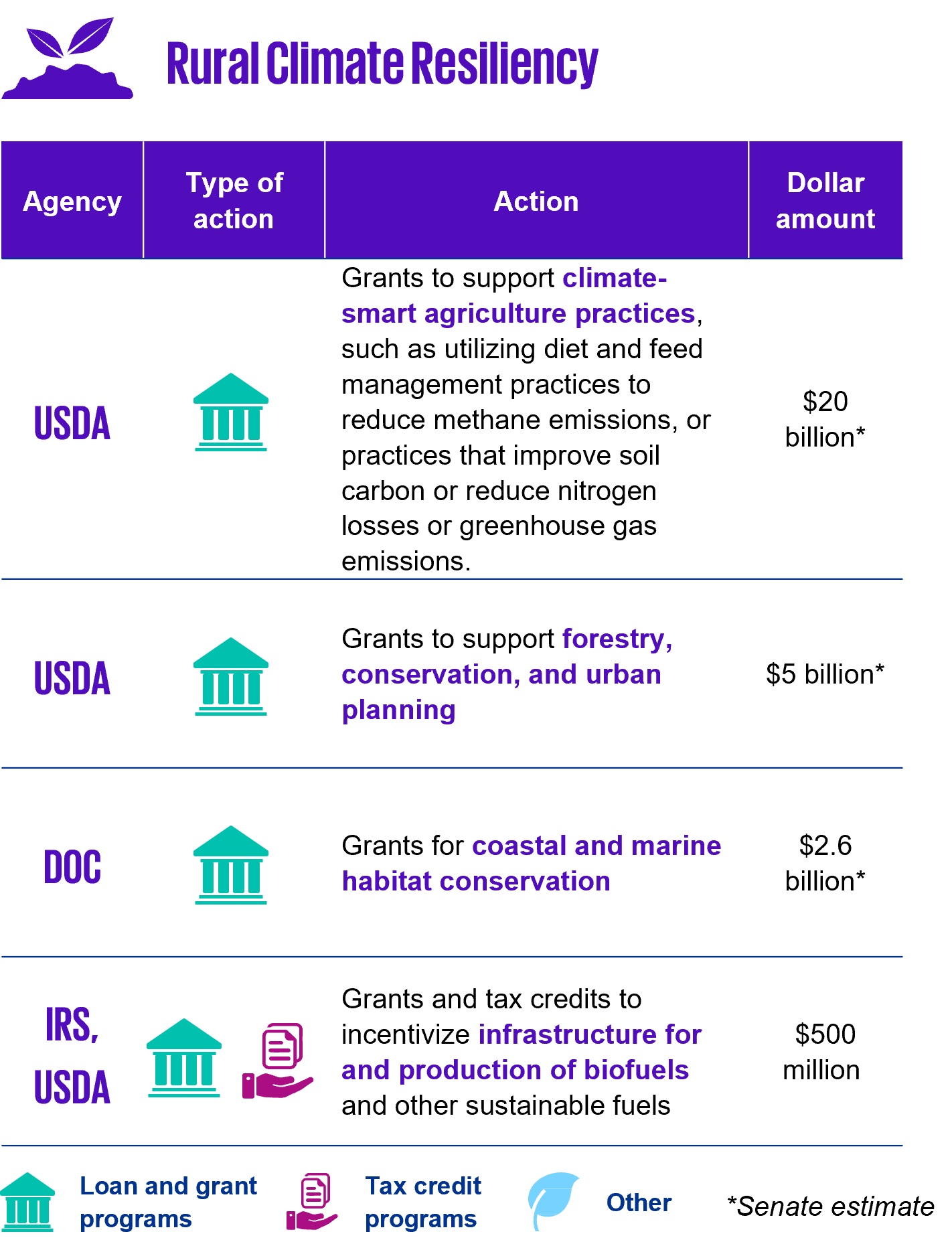

Rural Climate Resiliency

These provisions focus on the role of agricultural producers and forest landowners in climate solutions by providing grants for climate-smart agriculture practices, forest restoration, and land conservation. It would also provide grants and tax incentives for clean energy development in rural communities.

Please also refer to these KPMG Regulatory Insights Regulatory Alerts:

- KPMG Regulatory Alert | New Executive Actions on Climate

- KPMG Regulatory Alert | Environmental Justice: New DOJ Strategy

- KPMG Regulatory Point of View | Gearing up for evolving ESG regulations

Explore more

Meet our team

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.