Sustainability reporting at tech, media and telco companies

TMT leads in several areas, but biodiversity opportunities remain

KPMG releases latest global trends in sustainability reporting

The KPMG Survey of Sustainability Reporting 2022, now in its 12th edition, examines sustainability reporting trends around the world. Businesses are today on the precipice of mandatory and regulated sustainability reporting frameworks that make reporting consistent, as well as enable business leaders and stakeholders to measure and compare impacts and outcomes.

In addition to the regulatory element, the latest KPMG CEO Outlook shows that 55 percent of technology and telecommunication company chief executive officers (CEOs) believe environmental, social, and governance (ESG) programs improve their company’s financial performance. This is up significantly from last year (38 percent for tech companies and 28 percent for telcos). That makes sustainability initiatives and their associated reporting long-term commitments that company leaders should budget human and financial resources against.

For this year’s sustainability reporting study, KPMG professionals analyzed financial, sustainability, and ESG reports and websites for the top 100 companies in 58 countries, territories, and jurisdictions. These 5,800 companies are referred to as the “N100” group and represent a thorough global sample. Technology, media, and telecommunications (TMT) companies account for 10 percent of the N100.

TMT is a leader in reporting carbon reduction targets

The Task Force on Climate-related Financial Disclosures (TCFD) was established in 2015 by the Financial Stability Board to improve corporate reporting on climate-related risks and enable financial stakeholders to factor climate-related risks into their decisions. Within two years, this spurred more than half of the N100 to disclose climate and carbon reduction targets in some fashion. That number stands at 71 percent today.

Resource-intensive sectors such as automotive and mining have emerged as leaders in carbon target reporting. However, noticeable growth in TMT is very encouraging, and the sector now ranks third after moving from 61 percent in 2017 to 81 percent in 2022. TMT companies have long been socially conscious champions of environmental stewardship and are leveraging their resources and visibility to be innovators and influencers in this area.

Reporting of carbon targets by sector (2017-2022)

TMT more than doubles in TCFD adoption

The study shows a notable increase in companies specifically adopting the TCFD recommendations, especially since the G7 nations agreed to mandate TCFD-aligned climate-related financial reporting in 2021. Now, one-third (34 percent) of the N100 report using TCFD recommendations—nearly double the 2020 figure.

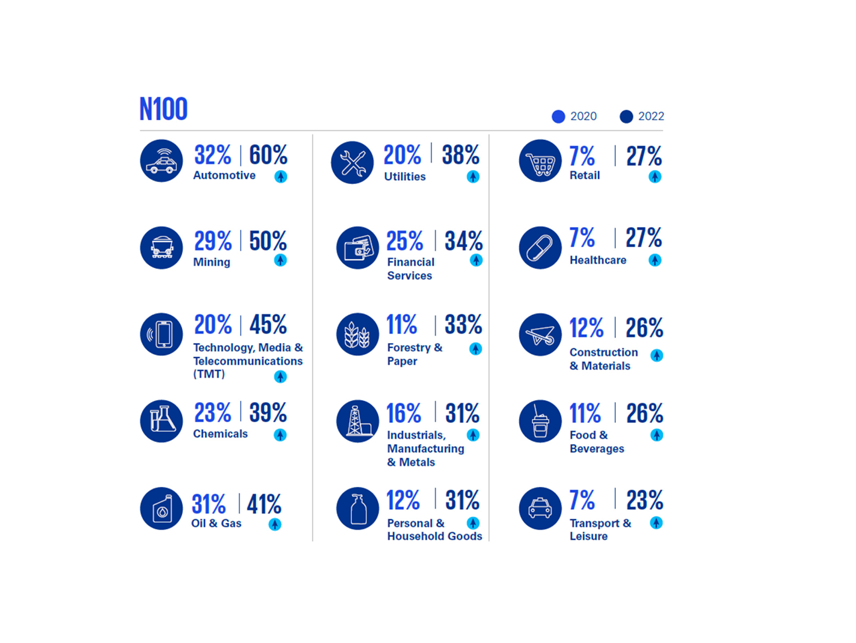

TCFD adoption is led by the automotive (60 percent), mining (50 percent), and TMT (45 percent) sectors. TMT’s adoption more than doubled since 2020, a rate that outpaced many of the other top sectors. As ESG disclosures continue to gain momentum in capital markets, clear and consistent climate reporting will become essential for all companies. While the upward trend is encouraging, there is clearly room for improvement.

TCFD Adoption by sector (2020-2022)

Source: KPMG Survey of Sustainability Reporting 2022, KPMG International, September 2022

TMT lags in biodiversity risk reporting

In 2020, the KPMG study explored for the first time how companies report on the risks they face from the loss of nature and biodiversity, and only considered sectors at “high or medium” risk. In 2022, this view was expanded across all sectors. Recognition of this risk has become more urgent and pronounced with biodiversity and nature risks impacting businesses and their supply chains.

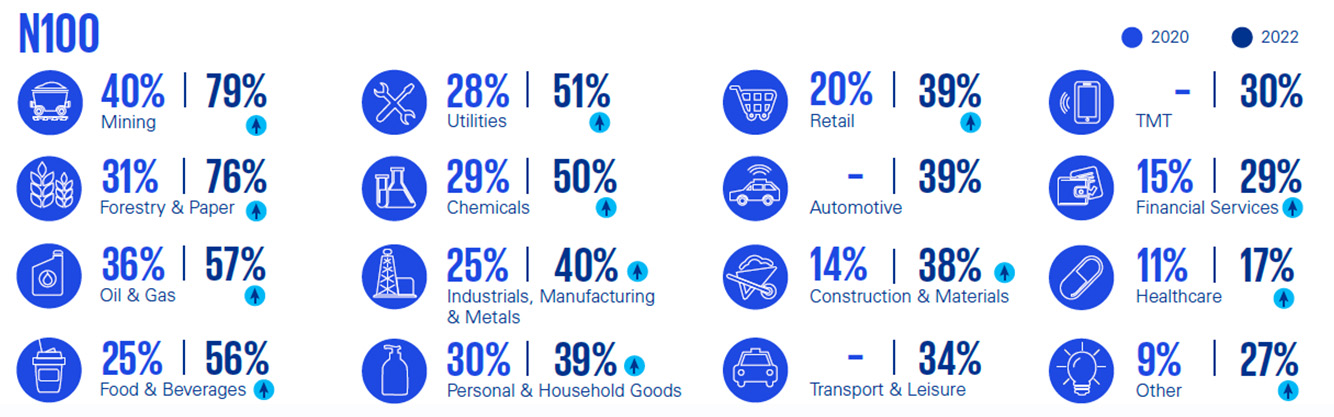

The review across all sectors shows that an average of 40 percent of the N100 currently report the loss of biodiversity or nature as a risk to their business. While TMT is not considered a high or medium risk sector, this year’s initial benchmark shows 30 percent report on biodiversity risk. This is significantly below the average and an area of opportunity for TMT companies.

Biodiversity reporting rates by sector (2020-2022)

Source: KPMG Survey of Sustainability Reporting 2022, KPMG International, September 2022

Biodiversity risk reporting requires rapid development since the strengthening of the world’s biodiversity and natural systems can mitigate climate change. The introduction of new reporting standards, such as the Task Force on Nature-related Financial Disclosures, is key to driving disclosure improvements and standardization.

TMT tops in reporting assurance again

Independent external assurance of sustainability reporting enhances the credibility of the information and fosters trust with stakeholders. Adoption generally starts with limited assurance. Then over time, through the maturation of the markets and regulatory requirements, the needle moves towards more reasonable assurance.

Close to half (49 percent) of the N100 obtained independent third-party assurance in 2020. In 2022, the assurance rate decreased to 47 percent among the N100, but further regulation could drive this number back up in coming years.

TMT leads all industries in this metric, showing steady, incremental progress over the last three research cycles. The sector currently sits at a 64 percent assurance rate, far above the N100 average.

Assurance rates by sector (2017-2022)

Sustainability reporting considerations for TMT companies

Sustainability reporting is a rapidly evolving field with various frameworks, with some overlapping requirements but no global consistency. The range of ESG metrics and disclosure frameworks used is vast and varies by sector, size, complexity, and location. Company performance is being ranked by many different indices and benchmarks.

An increasing number of investors also take nonfinancial data just as seriously as financial data. They believe companies that measure and report ESG risks are also more likely to be managing these risks better and delivering greater long-term value. Here are some tangible ways TMT businesses can invest in sustainability reporting:

- Understand the impact of climate change on financial statement disclosures.

- Align your sustainability and ESG reporting with key mandatory and voluntary reporting frameworks. These could include the TCFD, GRI Standards, and Sustainability Accounting Standards Board.

- Determine what your stakeholders expect you to report on.

- Create effective ESG reporting based on materiality assessments and benchmarking.

KPMG ESG Advisory can show TMT companies how to enhance trust, mitigate risk, and unlock new value to build a sustainable future. KPMG can provide training, undertake materiality assessments, help review ESG disclosures for compliance with existing reporting requirements, and benchmark against good practices.

Explore more insights

Meet our team